NC& Co.,Ltd (KOSDAQ:092600) shareholders have had their patience rewarded with a 32% share price jump in the last month. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 28% in the last twelve months.

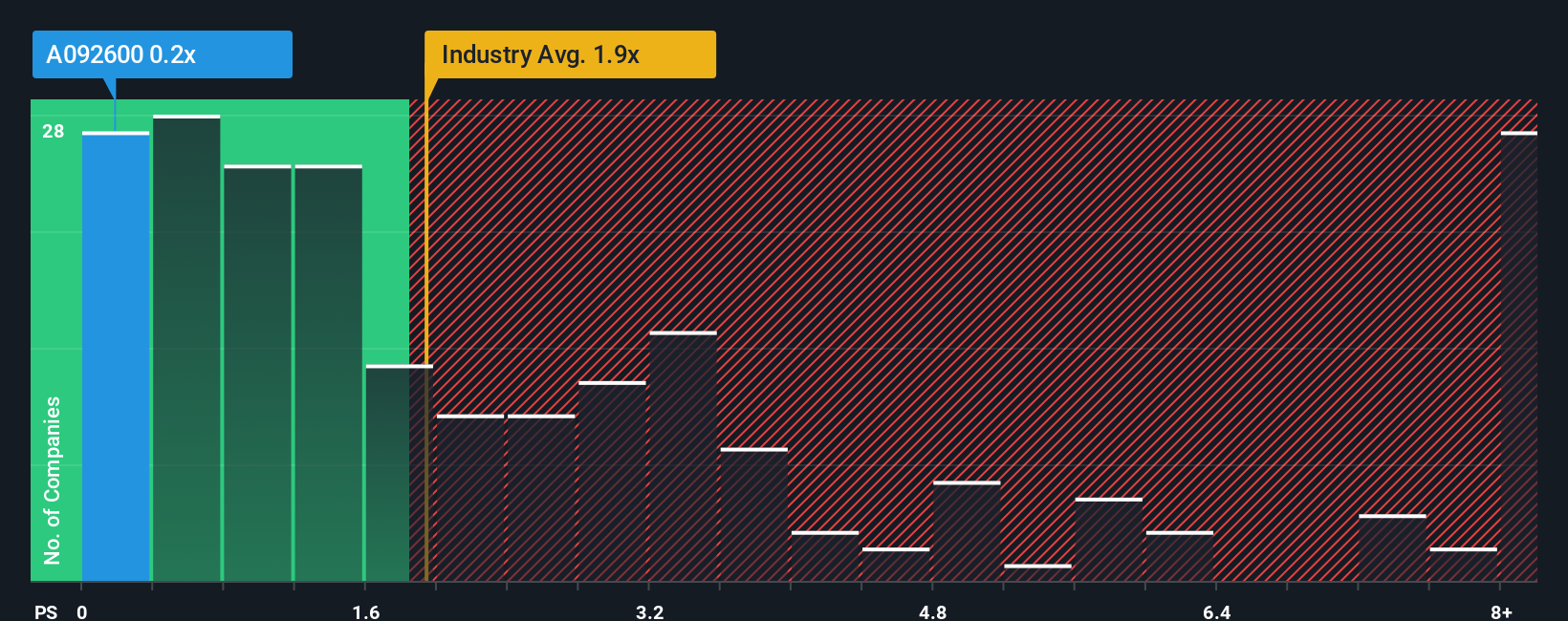

Although its price has surged higher, NC&Ltd may still be sending bullish signals at the moment with its price-to-sales (or “P/S”) ratio of 0.2x, since almost half of all companies in the Semiconductor industry in Korea have P/S ratios greater than 1.9x and even P/S higher than 5x are not unusual. However, the P/S might be low for a reason and it requires further investigation to determine if it’s justified.

This technology could replace computers: discover the 20 stocks are working to make quantum computing a reality.

Check out our latest analysis for NC&Ltd

What Does NC&Ltd’s P/S Mean For Shareholders?

Revenue has risen firmly for NC&Ltd recently, which is pleasing to see. Perhaps the market is expecting this acceptable revenue performance to take a dive, which has kept the P/S suppressed. If you like the company, you’d be hoping this isn’t the case so that you could potentially pick up some stock while it’s out of favour.

Although there are no analyst estimates available for NC&Ltd, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.

Is There Any Revenue Growth Forecasted For NC&Ltd?

There’s an inherent assumption that a company should underperform the industry for P/S ratios like NC&Ltd’s to be considered reasonable.

Retrospectively, the last year delivered an exceptional 20% gain to the company’s top line. Still, revenue has barely risen at all from three years ago in total, which is not ideal. Accordingly, shareholders probably wouldn’t have been overly satisfied with the unstable medium-term growth rates.

This is in contrast to the rest of the industry, which is expected to grow by 105% over the next year, materially higher than the company’s recent medium-term annualised growth rates.

With this information, we can see why NC&Ltd is trading at a P/S lower than the industry. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

What We Can Learn From NC&Ltd’s P/S?

Despite NC&Ltd’s share price climbing recently, its P/S still lags most other companies. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

In line with expectations, NC&Ltd maintains its low P/S on the weakness of its recent three-year growth being lower than the wider industry forecast. Right now shareholders are accepting the low P/S as they concede future revenue probably won’t provide any pleasant surprises. If recent medium-term revenue trends continue, it’s hard to see the share price experience a reversal of fortunes anytime soon.

It is also worth noting that we have found 3 warning signs for NC&Ltd (2 don’t sit too well with us!) that you need to take into consideration.

If you’re unsure about the strength of NC&Ltd’s business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we’re here to simplify it.

Discover if NC&Ltd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free Analysis

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

link